Loading

Get Tax Consultant Reactivation Application - State Of Oregon

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TAX CONSULTANT REACTIVATION APPLICATION - State Of Oregon online

This guide provides a comprehensive overview of how to complete the Tax Consultant Reactivation Application for the State of Oregon online. By following these steps, you will ensure that your application is filled out correctly and submitted without any issues.

Follow the steps to successfully complete your application.

- Press the ‘Get Form’ button to access the application and open it in your preferred PDF editor.

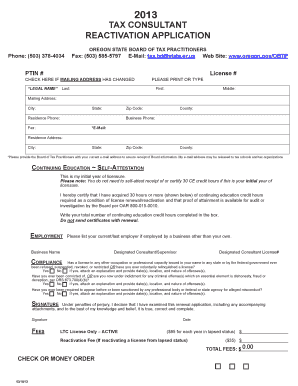

- Begin by filling in your legal name in the designated fields for 'Last', 'First', and 'Middle' names. Ensure that you provide accurate information as this will be used for identification purposes.

- Enter your mailing address, including city, state, zip code, and county. If your mailing address has changed, be sure to check the box indicating this change.

- Provide your residence and business phone numbers. Additionally, include your fax number and email address. Note that your email may be used for communication by the Board of Tax Practitioners.

- Fill in your residence address with the same format as your mailing address, specifying city, state, zip code, and county.

- For the continuing education section, indicate whether it is your initial year of licensure. If you are reactivating your license, self-attest that you have completed at least 30 hours of continuing education credits. Write the total number of hours completed in the provided box.

- If you are currently employed by a business other than your own, list the name of your employer, along with the designated consultant/supervisor and their license number.

- Complete the compliance questions regarding any licenses that may have been refused, suspended, revoked, or restricted in any state, and provide details if applicable. The same applies to any criminal offenses or professional sanctions.

- Sign and date the application. Your signature certifies that the information provided is true and correct to the best of your knowledge.

- Calculate the total fees required for your application based on your lapsed license status. Ensure to include the appropriate payment method information.

- After completing the form, save your changes. You may then download, print, or share the form as needed for submission.

Complete your documents online today to ensure a smooth reactivation process.

Yes, there is a statute of limitations concerning the collection of state taxes owed in Oregon, typically lasting for 10 years. This means the state can collect on a tax liability for a decade after it is assessed. Understanding these timelines can help you in tax planning and avoiding unnecessary liabilities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.