Loading

Get Nyc Tc 150

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nyc Tc 150 online

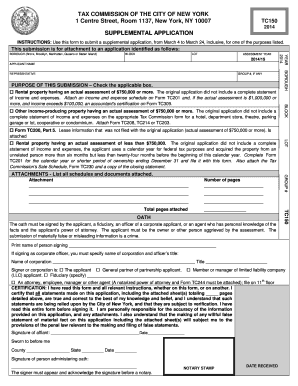

Filling out the Nyc Tc 150 form can be a straightforward process when you understand each section and its requirements. This guide provides a step-by-step approach to help you complete the supplemental application accurately and efficiently.

Follow the steps to complete your application online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering the block number, lot number, and assessment year (2014/15) related to your application.

- Indicate the purpose of your submission by checking the appropriate box for your income-producing property or rental property assessment.

- Provide details about the borough of your property and the representative's information.

- Sign the oath indicating that you, or the authorized person, have personal knowledge of the facts provided. Ensure that this is done in front of a notary.

- Once all sections are completed, you can save changes, download, print, or share the form as required.

Take the next step by completing the Nyc Tc 150 online today!

Seniors do not completely stop paying property taxes in New York at a certain age. However, turning 65 opens the door to various tax relief options and exemptions. It is essential to explore available programs and their requirements to maximize potential savings. Engaging with resources like NYC TC 150 allows seniors to better manage their financial responsibilities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.