Loading

Get Form Pta4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Pta4 online

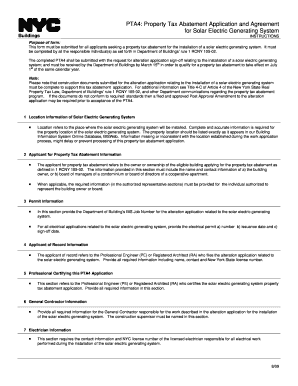

Filling out the Form Pta4 is a critical step for applicants seeking a property tax abatement for the installation of a solar electric generating system. This guide provides clear, step-by-step instructions to assist you in accurately completing the form online.

Follow the steps to complete the Form Pta4 online.

- Click ‘Get Form’ button to obtain the form and open it in your editor. Make sure to have all necessary information at hand for a smooth filling process.

- Provide the location information for the solar electric generating system. Ensure accuracy by entering the property location exactly as it appears in the Building Information System (BIS) database.

- Fill out the applicant for property tax abatement information, including the name and contact details of the building owner or the board of managers of a condominium or cooperative apartment.

- Enter the permit information including the BIS Job Number for the alteration application and details of the electrical permit related to the solar electric generating system.

- Input the applicant of record information, specifically identifying the Professional Engineer or Registered Architect who filed the alteration application.

- Provide details for the general contractor responsible for the installation, including the name of the construction supervisor.

- Include the electrician's information, providing contact details and NYC license number for the licensed electrician performing the electrical work.

- Specify the date on which the solar electric generating system was placed in service, which is also the date for requesting construction sign-off.

- List comprehensive details of the solar electric generating system, including product name, serial number, manufacturer contact information, total projected power generation, and installer details.

- Itemize eligible expenditures incurred on or after August 5, 2008, and ensure consistency with the costs submitted on the PW-3 for the solar generating system alteration application.

- Have the registered design professional complete the professional certification of compliance, signing, dating, and sealing this section.

- Finally, the applicant for property tax abatement must review, sign, and date the agreement section to certify understanding and acceptance of the terms.

- Once all sections are completed, save changes, and download or print the form as needed for submission.

Begin filling out the Form Pta4 online today to apply for your property tax abatement.

You claim your solar tax credit from the IRS by filling out Form 5695 and including it with your tax return. This form details the expenses you incurred for your solar energy system. Ensure that all necessary documentation is attached, and consider using Form Pta4 for streamlined record-keeping to simplify the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.