Get Schedule Rnr Massachusetts 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule Rnr Massachusetts 2012 Form online

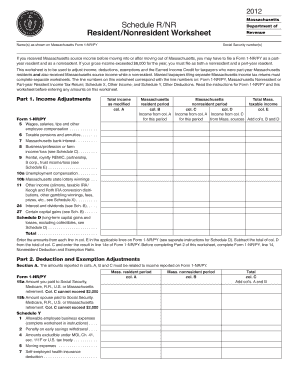

Filling out the Schedule Rnr Massachusetts 2012 Form online is an essential step for taxpayers who are part-year residents or nonresidents receiving Massachusetts source income. This guide provides a detailed walkthrough of each section of the form, ensuring a clear understanding of its components and requirements.

Follow the steps to fill out the form accurately.

- To obtain the Schedule Rnr Massachusetts 2012 Form, use the ‘Get Form’ button to access the document in your preferred online editor.

- Begin with the basic information: enter your name(s) as shown on the Massachusetts Form 1-NR/PY and your Social Security number(s). This information is crucial to accurately identify you in the system.

- In Part 1, Income Adjustments, carefully enter all sources of income. This includes wages, pensions, and any other types of taxable income. Ensure to report amounts separately for your Massachusetts resident and nonresident periods.

- Follow the corresponding line numbers for the income adjustments that relate to the Form 1-NR/PY, completing each field accurately based on your financial records.

- Once you have input all income adjustments, move on to Part 2, Deduction and Exemption Adjustments. Here, document your deductions, ensuring they align with the income previously reported.

- Complete Section A by indicating amounts related to Social Security, employee business expenses, and any other relevant deductions, maintaining organization between the Massachusetts resident and nonresident periods.

- Proceed to Section B, where you will enter details for care expenses for dependents and applicable exemptions. Pay special attention to the criteria for dependents to avoid errors.

- After filling out all sections, review the entries for accuracy and completeness. Check that all columns (A, B, C, D, and E) are filled appropriately and match the required amounts.

- Finally, you can save the changes made to the Schedule Rnr Massachusetts 2012 Form. Options will be available to download, print, or share the form as needed.

Start filling out your Schedule Rnr Massachusetts 2012 Form online today to ensure a smooth filing process.

The 183 day rule in Massachusetts refers to a guideline for determining residency for tax purposes. If you spend 183 days or more in Massachusetts during the tax year, you are considered a resident and must file a state tax return. This is crucial for understanding your obligations with the Schedule Rnr Massachusetts 2012 Form. If you are uncertain about your status, using tools available on platforms like USLegalForms can provide clarity.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.