Get A 830 Issued September 17 2010 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the A 830 Issued September 17 2010 Form online

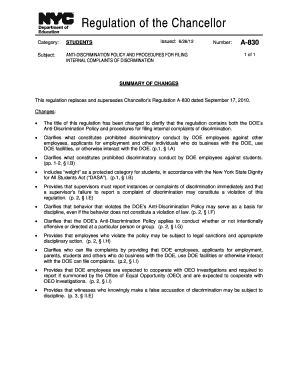

The A 830 Issued September 17 2010 Form is an essential document for filing internal complaints of discrimination within the New York City Department of Education. This guide will assist users in navigating the form step by step, ensuring a clear understanding of its components and requirements.

Follow the steps to accurately complete the A 830 form online.

- Click ‘Get Form’ button to obtain the form and open it in the document editor.

- Fill in the complainant information section, including your name, title, and contact details. Ensure to include student’s name if applicable.

- Indicate the nature of your complaint by checking the appropriate boxes that apply to your situation. This may include categories such as age, gender, race, or disability.

- Provide names and titles of individuals you believe discriminated against you in the designated fields. Include multiple individuals if necessary.

- Describe the location where the incident took place, along with specific dates when the alleged discrimination occurred.

- Explain in detail what transpired during the incident, making sure to include evidence or witnesses where possible. Use additional pages if necessary.

- State the relief or corrective action you are seeking as a result of the discrimination. Be clear and concise in your request.

- Sign and date the form to confirm the authenticity of your complaint before submission.

- Once you have completed the form, save your changes. You may then download, print, or share the form as necessary to submit it to the Office of Equal Opportunity.

Start filling out your A 830 Issued September 17 2010 Form online today to ensure your voice is heard.

Calculating general business credit involves identifying the various credits you are eligible for and summing them up according to IRS guidelines. Each type of credit has its specific requirements and calculations. Once you have determined the total credits, apply the necessary limitations to ensure compliance. The A 830 Issued September 17 2010 Form can streamline this process by providing the essential steps for accurate calculation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.