Loading

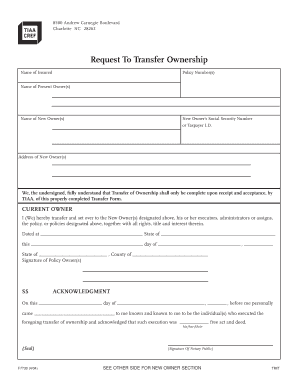

Get Request To Transfer Ownership. Complete This Form To Transfer The Ownership Of Your Life Insurance

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Request To Transfer Ownership form for your life insurance online

Transferring ownership of your life insurance policy is a significant decision that requires careful attention to detail. This guide provides a step-by-step approach to accurately fill out the Request To Transfer Ownership, ensuring a smooth process as you complete the transfer online.

Follow the steps to successfully complete the transfer form.

- Click the ‘Get Form’ button to obtain the Transfer Ownership form and open it in the digital editor.

- Enter the name of the insured individual in the designated field. This is the person whose life is covered by the insurance policy.

- Input the policy number(s) associated with the life insurance policy. Ensure that all relevant policies are included for the transfer.

- Provide the name of the current owner(s) of the policy. This identifies the individual(s) who currently hold ownership rights.

- In the next section, enter the name of the new owner(s) to whom you wish to transfer the ownership. Ensure that the spelling is correct and matches any legal documents.

- Fill in the Social Security number or Taxpayer Identification number of the new owner(s) as required. This information helps verify the identity of the new owner.

- Enter the address of the new owner(s), including street address, city, state, and zip code.

- Review the acknowledgment section. This confirms that the transfer will only be complete upon acceptance by TIAA of the properly completed form.

- Sign the form as the current owner(s). This signature indicates that you authorize the transfer of ownership.

- For notarization, you will need to complete the acknowledgment section in front of a notary public. This requires their signature and seal.

- Proceed to the new owner section where they must sign, acknowledging their agreement to the terms of ownership.

- Once completed, save the changes to your document. You can then download, print, or share the filled form as needed.

Complete your transfer of ownership online today to secure the future of your life insurance policy.

Ownership is a willing assumption of responsibility for an agreed program of policies, by officials in a borrowing country who have the responsibility to formulate and carry out those policies, based on an understanding that the program is achievable and is in the country's own interest.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.