Get Genworth Required Minimum Distribution Authorization Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Genworth Required Minimum Distribution Authorization Form online

Filling out the Genworth Required Minimum Distribution Authorization Form online can seem daunting, but with this guide, you'll navigate the process with ease. This step-by-step guide offers clear instructions for each section of the form to ensure a complete and accurate submission.

Follow the steps to successfully complete the authorization form.

- Click the ‘Get Form’ button to access the Genworth Required Minimum Distribution Authorization Form online.

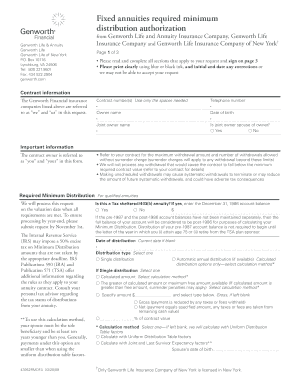

- Begin with the contract information section. Enter the contract number(s), owner name, date of birth, and if applicable, the joint owner name. Indicate whether the joint owner is a spouse.

- Review the important information provided about maximum withdrawal amounts and the impact of unscheduled withdrawals. Ensure you are aware of the surrender charges that may apply.

- In the Required Minimum Distribution section, respond to whether it is a tax-sheltered or 403(b) annuity. Provide the December 31, 1986 account balance if applicable.

- Select the distribution type: choose between a single distribution or automatic annual distribution. If choosing a single distribution, specify the amount or calculation method.

- In the payment method section, indicate how you want to receive the payment—via check or electronic funds transfer. Fill in the necessary details for the chosen method.

- Complete the tax information section that includes withholding notices. Indicate your choices regarding federal and state tax withholding.

- In the declaration and signature section, sign to certify that all information provided is true. Ensure you include the date and any applicable titles.

- Once all fields are completed, save your changes. You may choose to download, print, or share the form as needed.

Complete your documents online with confidence using this guide.

The lawsuit against Genworth Life Insurance stems from allegations related to claims handling and policy mismanagement. This legal action has created discussion in the industry, prompting the company to reinforce its commitment to customer service. If you have concerns about your policy, utilizing the Genworth Required Minimum Distribution Authorization Form may help you navigate the process more smoothly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.