Loading

Get Wv It140es Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wv It140es Form online

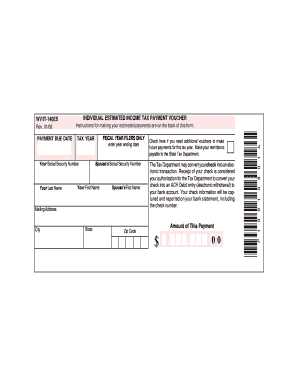

The Wv It140es Form, also known as the individual estimated income tax payment voucher, is essential for individuals who expect to owe state taxes. This guide provides clear steps for users to confidently fill out the form online, ensuring all necessary information is accurately submitted.

Follow the steps to complete the Wv It140es Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the tax year by inputting the year ending date in the designated field.

- Provide your Social Security number in the appropriate box to identify your tax record.

- Fill in your last name and first name as they appear on your tax documents.

- If applicable, enter your spouse’s Social Security number, followed by their first name.

- Complete your mailing address, including the city, state, and zip code to ensure proper delivery of correspondence.

- Indicate if you need additional vouchers for future payments by checking the relevant box.

- Write the amount of this payment in the designated box, ensuring it's formatted correctly.

- Review all entered information for accuracy and completeness before saving the form.

- Once completed, you can save your changes, download a copy, print it for your records, or share the form as necessary.

Complete your Wv It140es Form online today to ensure timely payments.

Yes, you can file your state taxes conveniently with H&R Block online. They simplify the process by using forms like the Wv It140es Form. This option is beneficial if you're looking for assistance while navigating your state tax filing. Utilizing such platforms can streamline your experience and help ensure you maximize your deductions and credits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.