Get Wv Partnership Form It 165

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wv Partnership Form It 165 online

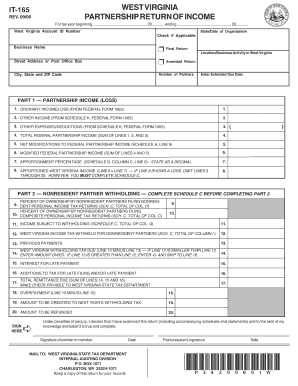

This guide provides clear, comprehensive instructions on how to complete the West Virginia Partnership Return of Income Form IT-165 online. Whether you are a partnership filing your taxes or a partner seeking to ensure compliance, this step-by-step guide will assist you throughout the process.

Follow the steps to successfully complete your Wv Partnership Form It 165 online.

- Click the ‘Get Form’ button to obtain the Wv Partnership Form IT-165 and open it for editing.

- Fill in the tax year information, including the beginning and ending dates for the partnership income tax period.

- Enter your West Virginia Account ID number, state and date of organization, and check applicable boxes such as 'Final Return' or 'Amended Return'.

- Complete the 'Business Name' and 'Location/Business Activity in West Virginia' by providing the street address, city, state, and ZIP code.

- Indicate the number of partners in the partnership and provide any extended due date if applicable.

- Move to Part 1 — Partnership Income (Loss). Enter the ordinary income or loss from federal Form 1065 and complete the other income, expenses, and modifications as applicable.

- Determine the apportioned West Virginia income by completing lines that calculate the income based on the apportionment percentage.

- Proceed to Part 2 — Nonresident Partner Withholding. Complete Schedule C before entering details regarding nonresident partners and the amount of withholding tax required.

- Review all figures for accuracy and finalize any other applicable schedules such as Schedule A or Schedule B based on your partnership's income.

- Once all sections are completed, save your changes, and choose to download, print, or share the completed form as needed.

Complete your Wv Partnership Form IT-165 online today to ensure timely filing and compliance.

You can file the 1065 partnership return electronically through the IRS website or by mailing it to the appropriate address based on your location. For West Virginia partnerships, the Wv Partnership Form It 165 can be filed along with your federal taxes. Make sure to check the specific instructions for any updates. If you want assistance, uslegalforms can provide direction on the correct filing methods.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.