Loading

Get Certificate Of Exemption 1. - State Wv

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Certificate Of Exemption 1. - State Wv online

This guide provides clear instructions on how to fill out the Certificate Of Exemption 1. - State Wv effectively. Follow these steps to ensure correct completion of this essential document.

Follow the steps to successfully complete the exemption certificate.

- Press the ‘Get Form’ button to access the exemption certificate form and open it in your document editor.

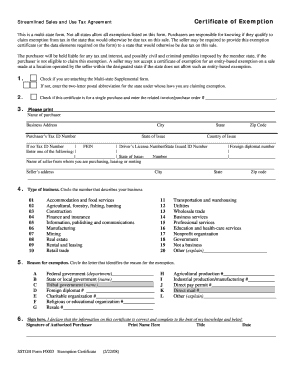

- Determine if you need to attach the Multi-state Supplemental form. If not, enter the two-letter postal abbreviation for the state under whose laws you are claiming exemption.

- Indicate if this certificate is for a single purchase and provide the related invoice or purchase order number. Then, enter the name of the purchaser as it appears on official documents.

- Complete the business address of the purchaser, including city, state, and zip code. Include the Purchaser’s Tax ID number, state of issue, and country of issue.

- If the Purchaser’s Tax ID number is not available, input an alternative identification method such as FEIN, driver’s license number, or foreign diplomat number.

- Fill in the name of the seller from whom you are purchasing, leasing, or renting, along with their address, city, state, and zip code.

- Select the type of business by circling the corresponding number from the provided list.

- Identify the reason for exemption by circling the appropriate letter from the listed options.

- Sign the certificate, confirming that the information provided is complete and accurate to the best of your knowledge. Include your printed name, title, and date.

- Once all sections are completed, save your changes. You may then download, print, or share the form as needed.

Complete your Certificate Of Exemption 1. - State Wv online today and ensure compliance with state tax regulations.

The personal exemption in West Virginia typically refers to the amount of income excluded from taxation based on your filing status and number of dependents. This exemption reduces your taxable income, impacting your overall tax liability. Understanding your personal exemption helps in accurate tax planning, and resources like the Certificate Of Exemption 1 - State WV can assist in maximizing your benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.