Loading

Get Property Tax Forms And Publications - Wv State Tax Department

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Property Tax Forms And Publications - WV State Tax Department online

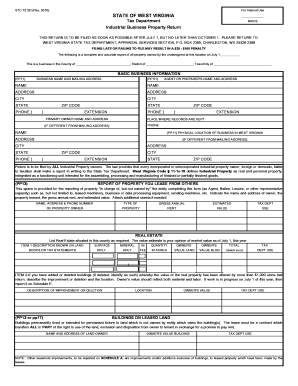

Filling out the Property Tax Forms is an essential process for industrial property owners in West Virginia. This guide provides step-by-step instructions to help users complete the forms accurately and efficiently online.

Follow the steps to successfully complete your property tax forms online.

- Press the ‘Get Form’ button to access the document and open it for editing.

- Begin by entering your basic business information. Provide your business name, mailing address, and contact information. Include details such as your primary owner's name and where records are maintained, ensuring accuracy.

- Report any property you lease from others in the designated section, specifying the name and address of the property owner, the type of property, gross annual rent, and estimated value.

- Enter your real estate information, including the description, owner's value, and relevant tax details for each item. This section requires careful evaluation of the property's market value.

- Complete the machinery, equipment, and furniture sections by detailing each item with acquisition costs, year of purchase, and owner values. This ensures all assets are accounted for appropriately.

- If applicable, fill out schedules for business inventory, unfinished construction, and any other personal property. Include necessary descriptions and values to support your claims.

- Review all completed sections for accuracy and clarity before saving your changes. Confirm that all required attachments, such as depreciation schedules or balance sheets, are included.

- Once satisfied, save your document, and download or print as needed for your records. Share the form with the necessary departments as per the filing requirements.

Complete your property tax forms online today to ensure you meet all filing deadlines.

In West Virginia, several exemptions can help reduce property taxes for eligible homeowners. The Homestead Exemption is particularly beneficial for seniors and disabled individuals, allowing them to exempt part of their residential property from taxation. Other exemptions include those for veterans and certain charitable organizations. For detailed information, refer to the Property Tax Forms And Publications - WV State Tax Department.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.