Loading

Get Capital Improvement Form Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Capital Improvement Form Fillable online

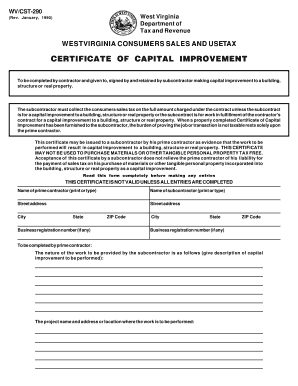

Filling out the Capital Improvement Form Fillable correctly is essential for ensuring compliance with sales tax regulations in West Virginia. This guide provides step-by-step instructions for completing the form online, ensuring clarity for users of all backgrounds.

Follow the steps to fill out the Capital Improvement Form Fillable efficiently.

- Click the ‘Get Form’ button to access the Capital Improvement Form Fillable. After obtaining the form, open it in your preferred online editor.

- Begin by entering the name of the prime contractor in the designated field. Ensure the information is accurate to maintain compliance.

- Next, fill out the name of the subcontractor in the corresponding section. This should reflect the party responsible for performing the work.

- Provide the street addresses for both the prime contractor and the subcontractor in the appropriate fields, including city, state, and ZIP code.

- If applicable, enter the business registration numbers for both the prime contractor and subcontractor. This information helps verify legitimacy.

- In the section labeled 'Nature of Work,' describe the capital improvement to be performed in clear and specific terms. This description is crucial for validating the capital improvement.

- Next, detail the project name and address or location where the work will take place. This helps ensure proper identification of the site.

- Confirm that the work to be performed meets the criteria for a capital improvement by reviewing the guidelines provided on the form.

- The prime contractor must sign and date the form, certifying the accuracy of the information provided and acknowledging responsibility for any taxes due if the work is not classified as a capital improvement.

- The subcontractor should also sign the form, certifying their agreement to complete the work as outlined. Ensure to attach any written contract if applicable.

- After completing all sections, save your changes, and consider downloading or printing a copy of the filled-out form for your records.

Complete your forms online to ensure a seamless processing experience.

A capital improvement refers to a significant enhancement made to property, which increases its value or extends its useful life. For example, installing a new roof or renovating a kitchen would qualify as capital improvements. These upgrades often require the use of a Capital Improvement Form Fillable to document the expenditures and potential tax benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.