Get Editable Wv Spf 100es

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Editable Wv Spf 100es online

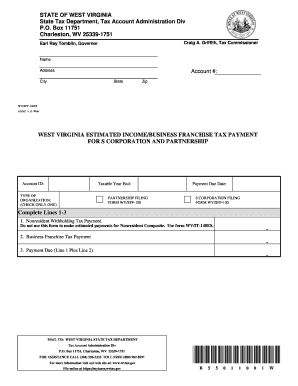

The Editable Wv Spf 100es is a crucial form for managing estimated income and business franchise tax payments for S corporations and partnerships in West Virginia. This guide provides clear, user-friendly instructions on how to effectively fill out this form online.

Follow the steps to complete the Editable Wv Spf 100es form online.

- Press the ‘Get Form’ button to access the Editable Wv Spf 100es and open it in your browser.

- Begin by filling out the name and address fields at the top of the form. Ensure that the information is complete and accurate to avoid processing delays.

- Enter your Account Number, Account ID, and the Taxable Year End in their designated fields. These details are essential for the proper identification of your tax account.

- Select the type of organization by checking the appropriate box for either S Corporation or Partnership. Make sure to select one only.

- Complete Lines 1 to 3. Line 1 is for Nonresident Withholding Tax Payment—if applicable—Line 2 for Business Franchise Tax Payment, and Line 3 should reflect the total payment due, which is the sum of Lines 1 and 2.

- Double-check all the information for accuracy before proceeding. Ensuring that all sections are completed correctly will help in processing your payment without issues.

- Once you have filled out the form, you can save your changes, then download, print, or share the form as necessary. Be sure to keep a copy for your records.

Complete your forms online today to ensure timely and accurate tax payments.

You can electronically file a tax extension by utilizing IRS-approved software to complete Form 4868 or state-specific forms like the Editable WV SPF 100ES. These platforms generally offer a step-by-step approach, which makes the process straightforward. After entering your information, simply follow the prompts to submit your extension online. This method not only saves time but also helps prevent mistakes during your filing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.