Get Nrw 2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NRW-2 online

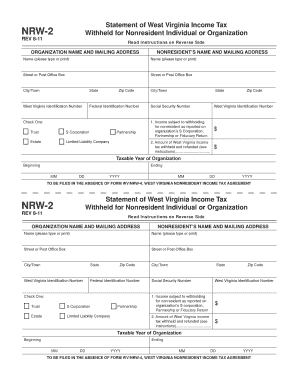

Filling out the NRW-2 form is essential for organizations in West Virginia that need to report income tax withholding for nonresident individuals or organizations. This guide provides a clear, step-by-step approach to completing the NRW-2 online.

Follow the steps to successfully complete the NRW-2 form.

- Click the ‘Get Form’ button to access the NRW-2 form and open it in the editor.

- Enter the organization name and mailing address in the appropriate fields. Ensure that the information is accurate and up to date.

- Complete the nonresident’s name and mailing address sections, using clear and legible type or print.

- Select the type of organization by checking the corresponding box. Options include Trust, S Corporation, Partnership, Estate, or Limited Liability Company.

- Fill in the relevant identification numbers, including the West Virginia Identification Number and the Federal Identification Number.

- Indicate the amount of income subject to withholding by entering the correct figure in the specified field.

- Enter the amount of West Virginia income tax that was withheld in the designated space.

- Identify the taxable year of the organization by filling in the beginning and ending dates.

- Once all fields are complete, review the form for accuracy and completeness. Make any necessary adjustments.

- Save your changes. You can download, print, or share the completed NRW-2 form as needed.

Complete your NRW-2 form online today to ensure compliance with West Virginia tax regulations.

Certain entities and transactions may qualify for exemption from West Virginia sales tax. For example, nonprofits, government agencies, and specific educational institutions often enjoy tax-exempt status. Additionally, some purchases related to manufacturing and agriculture may also be exempt. If you are unsure about your exemption status, consulting with a tax professional or using uslegalforms can clarify your eligibility.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.