Loading

Get Wv Ari 001 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wv Ari 001 Form online

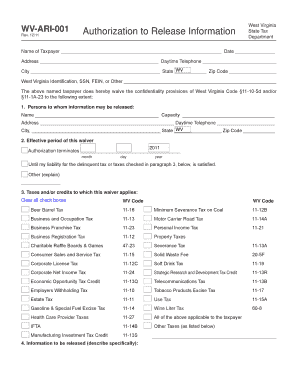

Filling out the Wv Ari 001 Form online is a straightforward process designed to facilitate the authorization for the release of tax information. This guide will provide clear, step-by-step instructions to help users navigate through the form with confidence.

Follow the steps to complete the Wv Ari 001 Form online.

- Click 'Get Form' button to access the form and open it in your preferred online editor.

- In the first section, enter the name of the taxpayer. This includes both first and last names as they appear on official documents.

- Fill out the address fields with the taxpayer's complete address, including city, state, and zip code.

- Indicate who will be authorized to receive the tax information by providing their name, capacity, address, and telephone number.

- Specify the effective period of this authorization waiver. Choose one of the provided options, including specific dates or conditions for termination.

- Select the applicable taxes or credits to which this authorization applies by marking the respective checkboxes.

- Provide the reason for the release of information in the designated area.

- After completing the form, print it out for signature. Make sure to obtain the necessary notarization and include any required documentation.

Complete your documents online today for a smoother process.

Completing a non-resident tax return involves gathering your income documents and using the appropriate WV IT-140NR form. It's essential to accurately report your income from West Virginia sources. For further assistance with understanding the process, the Wv Ari 001 Form can provide valuable information for a smooth filing experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.