Loading

Get Wvit 101a Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wvit 101a Form online

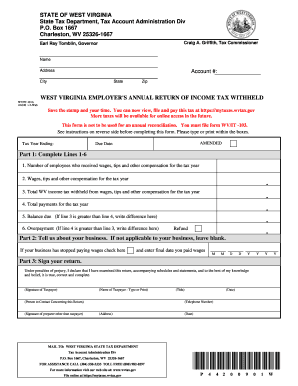

Filling out the Wvit 101a Form online is a straightforward process that allows users to manage their employer's annual return of income tax withheld efficiently. This guide will provide clear, step-by-step instructions to help users navigate the form with confidence.

Follow the steps to complete the Wvit 101a Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your basic information at the top of the form, including your name, address, account number, city, state, and zip code.

- In Part 1, complete lines 1-6 with the following: Line 1 requires the number of employees who received wages, tips, and other compensation for the tax year. Line 2 asks for the total wages, tips, and compensation paid during the tax year.

- In Part 2, provide information about your business. If your business has stopped paying wages, check the box and enter the final date wages were paid.

- In Part 3, sign your return. Ensure that the form is signed by the taxpayer or an authorized representative. Include their contact information for any follow-up questions.

- Review the completed form for accuracy, then save your changes before downloading or printing the form for submission. Ensure to send it to the West Virginia State Tax Department as directed.

Complete your Wvit 101a Form online today to streamline your filing process.

Yes, filling out an employee's withholding certificate, like the Wvit 101a Form, is essential to define how much tax to withhold from your paycheck. This form informs your employer about your personal tax situation. By accurately completing this form, you ensure that your state tax withholding aligns with your financial goals. Regularly reviewing your certificate can optimize your tax withholding.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.