Loading

Get Sev-401v - State Of West Virginia - State Wv

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SEV-401V - State Of West Virginia - State Wv online

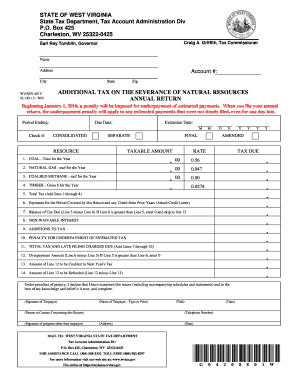

The SEV-401V form is essential for reporting additional tax on the severance of natural resources in West Virginia. This guide provides a detailed, step-by-step approach for successfully completing the form online, ensuring you meet all necessary requirements.

Follow the steps to accurately complete the SEV-401V form online.

- Press the ‘Get Form’ button to access the SEV-401V form and open it in your preferred editing tool.

- Begin by entering your name and address in the designated fields at the top of the form. Ensure that your information is accurate to avoid any future issues.

- Fill in your account number, city, state, and zip code, ensuring that all details match your records.

- Indicate the period ending date, the due date, and if applicable, the extension date.

- Check the boxes for your filing type: Consolidated, Separate, or Amended. Make sure to only select the type that applies to your situation.

- Report the different types of severed natural resources in the respective fields: Coal (in tons), Natural Gas (in mcf), Coalbed Methane (in mcf), and Timber (in gross dollars). Ensure that the values are accurate and reflect your operational results for the year.

- Calculate the total tax by adding the amounts from lines 1 through 4 and enter it in the Total Tax field.

- If applicable, list any payments for the period covered by this return and any credit from prior years, attaching a credit letter where necessary.

- Determine the balance of tax due by subtracting line 6 from line 5. If line 6 is greater than line 5, enter 0.

- If you owe non-waivable interest or additions to tax, include those amounts in the respective fields.

- Calculate any penalty for underpayment of estimated tax, and then sum lines 7 through 10 to arrive at the total tax and late filing charges due.

- If you have overpaid, calculate the amount by subtracting line 5 from line 6. If line 5 is greater, enter 0.

- If applicable, indicate how much of the overpayment amount you would like to credit to next year's tax.

- Finally, specify the amount of the overpayment you would like to be refunded, if any, by subtracting line 13 from line 12.

- Review all entries for accuracy, then sign the form by providing your signature and printing your name. Include any contact information requested.

- Once completed, you can save your changes, download, print, or share the form as needed.

Complete your SEV-401V form online today for efficient processing and compliance.

Yes, the West Virginia Secretary of State offers various online services to streamline access for residents. These services include online business registration, annual report submissions, and tracking of election results. Engaging with these online tools can save time and make transactions more convenient.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.