Get West Virginia Timber Severance Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the West Virginia Timber Severance Tax Form online

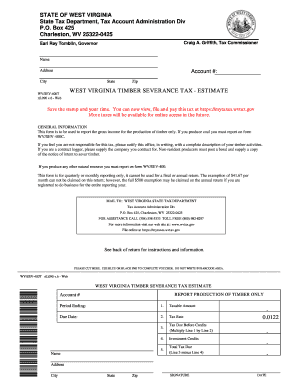

This guide provides clear, step-by-step instructions for filling out the West Virginia Timber Severance Tax Form online. It is designed to assist users in accurately reporting their timber production income while ensuring compliance with tax regulations.

Follow the steps to complete and submit the form online.

- To obtain the West Virginia Timber Severance Tax Form, select the 'Get Form' button to access the document in your online environment.

- Begin by providing your personal information in the designated fields. This includes your name, address, city, state, and zip code. Ensure all information is accurate to avoid processing delays.

- Next, enter your account number in the specified field. This number is crucial for identifying your tax account.

- Indicate the period ending date for which you are reporting your timber production. Accuracy here is important for proper reporting.

- In lines 1 and 2, report the taxable amount of timber produced and the applicable tax rate, respectively. Remember, the tax rate for timber severance is 0.0122.

- Calculate the tax due before credits by multiplying the figures entered in lines 1 and 2. Enter this amount on line 3.

- If applicable, report any investment credits on line 4 and calculate the total tax due by subtracting line 4 from line 3. Enter this final amount on line 5.

- Once you have completed the form, review all entries for accuracy. Make any necessary corrections.

- Finally, save your changes, then choose to download, print, or share the completed form as needed.

Complete your West Virginia Timber Severance Tax Form online today for a streamlined filing experience.

West Virginia tax form 140 is an individual income tax return form used by residents to report their income and calculate their state tax liability. While it is not specific to severance tax, understanding all tax obligations, including the West Virginia Timber Severance Tax Form, is essential for comprehensive tax planning. Maintaining accurate tax documentation ensures you avoid any surprises during tax season. Utilize both forms to manage your taxes effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.