Loading

Get Captive Reit Disclosure Form - Tn.gov - State Tn

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Captive REIT Disclosure Form - TN.gov - State Tn online

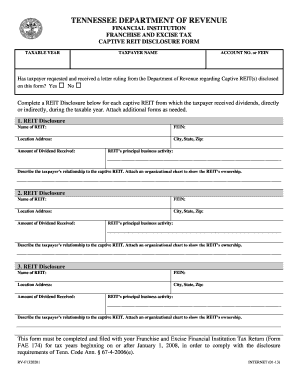

This guide provides clear, step-by-step instructions for completing the Captive REIT Disclosure Form required by the Tennessee Department of Revenue. Follow these directions to ensure accurate filing and compliance for your financial institution.

Follow the steps to accurately complete the Captive REIT Disclosure Form online.

- Press the ‘Get Form’ button to access the Captive REIT Disclosure Form and open it in your preferred online editor.

- Enter the taxable year as shown on your Franchise and Excise Financial Institution Tax Return. This is the period for which you are reporting.

- Input the legal name of the taxpayer in the designated field, ensuring accuracy to avoid discrepancies.

- Enter the taxpayer's franchise and excise tax account number or their federal employer identification number in the appropriate space.

- Indicate whether the taxpayer has requested and received a letter ruling regarding the captive REITs by checking the 'Yes' or 'No' box.

- For each captive REIT from which dividends were received, complete a REIT Disclosure section. Provide the REIT's legal name, FEIN, and location address, including city, state, and zip code.

- Enter the amount of dividends received from each captive REIT directly or indirectly during the taxable year.

- Describe the principal business activity of the REIT to ensure full transparency about its operations.

- Provide details about the taxpayer's relationship to the captive REIT. If applicable, attach an organizational chart to illustrate ownership.

- Repeat steps 6 to 9 for each additional captive REIT as necessary, attaching more forms if required.

- Once all information is complete, save your changes, and download or print the form. Ensure it is filed with your Franchise and Excise Financial Institution Tax Return by the due date.

Complete your documents online today to ensure timely and accurate filing.

The 75% rule for REITs requires that at least 75% of a REIT's income must come from real estate-related sources. This requirement supports the tax advantages that REITs enjoy under federal law. Familiarity with this rule is key as you navigate the Captive REIT Disclosure Form - TN - State Tn.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.