Get Reimbursement To State Of Nj Pension & Social Security Federally Funded Programs Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the reimbursement to state of Nj pension & social security federally funded programs form online

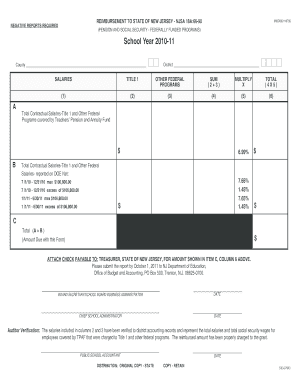

Completing the reimbursement to the state of New Jersey pension & social security federally funded programs form is an essential process for schools seeking reimbursement for contractual salaries from Title 1 and other federal sources. This guide will provide users with clear, step-by-step instructions on how to accurately fill out this form online, ensuring that all required information is correctly submitted.

Follow the steps to successfully complete the reimbursement form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify the school year at the top of the form, and enter the relevant year, such as '2010-11', in the designated field.

- Fill in the county information in the provided field accurately.

- Input the district name in the corresponding space to indicate your school's district.

- In section A, enter the total contractual salaries related to Title 1 and other federal programs into the appropriate field.

- For section B, calculate and enter the applicable percentages for social security deductions in the given fields, ensuring your calculations are accurate.

- In section C, sum the amounts from sections A and B and input the total into the designated area, as this amount will be due with the submission of the form.

- Verify the amount due as calculated correctly in item C, column 6, and prepare a check payable to the Treasurer, State of New Jersey for this amount.

- Ensure completion of the signature fields by signing and dating as the Board Secretary/School Board Business Administrator and Chief School Administrator.

- Finally, review the completed form for accuracy, save the changes, download a copy, and consider printing or sharing the form as needed.

Take action now and complete your reimbursement form online for efficient processing.

In New Jersey, you generally need to work a minimum of 10 years to qualify for pension benefits. This time frame may vary depending on the specific pension program or plan in question. Knowing the guidelines surrounding the Reimbursement To State Of NJ Pension & Social Security Federally Funded Programs Form can assist employees in better understanding their pension eligibility and planning for retirement.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.