Get Form 802

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 802 online

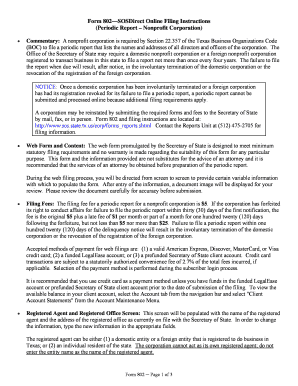

Filling out Form 802 online is a straightforward process that ensures your nonprofit corporation remains compliant with state requirements. This guide provides clear and detailed steps to assist you in completing the form efficiently.

Follow the steps to complete Form 802 online.

- Click the ‘Get Form’ button to access the form and open it in the editor.

- Review the registered agent and registered office screen. This section will already include the name of the registered agent and the registered office address. If any information needs updating, enter the new details in the respective fields. Remember, the registered agent cannot be the corporation itself.

- Confirm the consent of the registered agent. You can choose to continue without attaching consent or include a copy if you select ‘Consent attached.’ If including consent, ensure the file is in TIF, TXT, or PDF format.

- Provide the principal office address. This should be the location where the business records are maintained, including the street or mailing address.

- Enter the names and addresses of all directors. At least three directors are required to manage the corporation.

- Fill in the names, addresses, and titles of the officers. Include at least a president and a secretary, as well as any additional officers as needed.

- Proceed to the execution screen. Here, a person authorized to file the document must type their name in the signature field to affirm the accuracy of the information provided.

- After completing all inputs, review the document image presented on the display screen. Carefully check for any errors or omissions.

- Choose one of the following actions: click ‘Submit Filing’ to finalize your submission, ‘Edit Filing’ to make corrections, or ‘Cancel Filing’ to abort the process.

Start filling out your Form 802 online today to ensure compliance and maintain your nonprofit's status.

Form 8802 is used to request a Certificate of U.S. Residency, which proves that you are a resident for tax purposes. This certificate is important for individuals and businesses claiming benefits under international tax treaties. If you're planning to conduct business overseas, having Form 8802 is essential for avoiding double taxation. US Legal Forms provides valuable resources to guide you through the application process effortlessly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.