Loading

Get Notice To File Reports Electronically Form - Ohio Secretary Of State - Sos State Oh

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Notice To File Reports Electronically Form - Ohio Secretary Of State - Sos State Oh online

This guide provides a comprehensive overview of how to accurately complete the Notice To File Reports Electronically Form from the Ohio Secretary of State. Whether you are familiar with online filing or a first-time user, these instructions will help ensure a smooth process.

Follow the steps to complete your form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

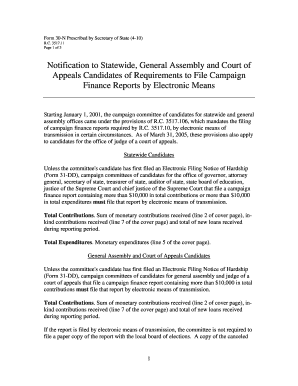

- Review the form to ensure you understand the sections, specifically the requirements for total contributions and expenditures, which determine if electronic filing is necessary.

- Fill out the candidate's information at the top of the form, including the name of the candidate and the office they are running for.

- In the contribution section, accurately enter all contributions received. Be sure to include both monetary and in-kind contributions, as well as any new loans.

- Complete the expenditures section by entering all monetary expenditures. This total will help determine the filing method required.

- If your report implies a hardship with electronic filing, ensure to attach the Electronic Filing Notice of Hardship (Form 31-DD) following the requirements specified.

- Once all fields have been completed, save your changes. Validate all information before proceeding.

- Submit the form electronically by following the prompt within the online system. Keep a digital copy for your records.

- After submission, remember to mail copies of canceled checks or paid receipts to the Ohio Secretary of State’s office, as required.

Begin your electronic filing journey by following these instructions to complete and submit your Notice To File Reports Electronically Form online.

To reinstate an Ohio LLC that's been administratively canceled for tax reasons, you'll need to obtain a Certificate of Tax Clearance from the Ohio Department of Taxation that clears you of tax liability. Then you'll need to submit the Certificate of Tax Clearance and the $25 filing fee to the Ohio Secretary of State.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.