Get Usda 502 Prequalification Information Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Usda 502 Prequalification Information Instructions online

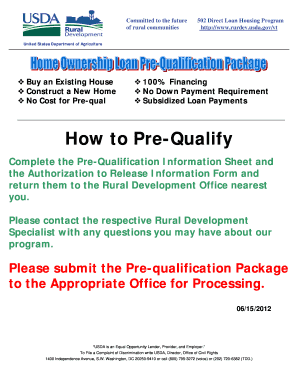

Filling out the Usda 502 Prequalification Information Instructions is an essential step for individuals seeking assistance through the USDA Rural Development programs. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately and confidently online.

Follow the steps to complete the Usda 502 Prequalification Information Instructions online.

- Click the ‘Get Form’ button to access the Usda 502 Prequalification Information form and open it in your preferred editing tool.

- Begin by entering the necessary personal information for each applicant, including their Social Security numbers, ages, and address.

- Fill in the contact details, including home and work phone numbers, and email addresses for both applicants.

- Select the marital status for each applicant and indicate whether you have a Section 8 voucher.

- Specify the desired towns for potential housing.

- Input the gross monthly employment income for all applicants. If self-employed or seasonal, contact your Rural Development Specialist for guidance.

- Include any other monthly income sources, such as food stamps, Social Security, child support, or pensions.

- List other household members, detailing the number of adults and children living in the home.

- Document your assets, including checking and savings account balances, stocks, bonds, and IRA accounts.

- Outline any debts, including real estate mortgages, car loans, child support payments, and any other expenses.

- Indicate where you heard about the USDA Rural Development program.

- Remember to sign and return the 'Authorization to Release' form along with the completed prequalification information.

- Once completed, review the form for accuracy and completeness, then save your changes. You may choose to download, print, or share the finished document as needed.

Take the first step towards your housing goals by completing the Usda 502 Prequalification Information Instructions online today!

USDA loans may be denied for several reasons, but the rate of denial is typically low when applicants follow guidelines. Issues such as insufficient income, poor credit history, or ineligible property types can lead to denials. Familiarizing yourself with the Usda 502 Prequalification Information Instructions can diminish the chances of denial, as it clearly outlines eligibility requirements. It is essential to prepare thoroughly and address any potential concerns before applying.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.