Loading

Get Billback Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Billback Form online

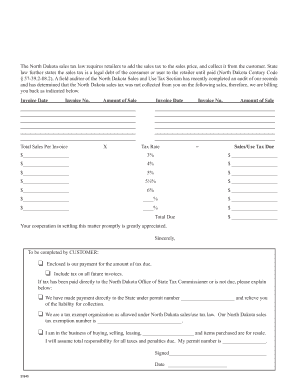

The Billback Form is essential for addressing sales tax discrepancies in North Dakota. This guide will help you navigate the online process of completing this form with ease and accuracy.

Follow the steps to fill out the Billback Form online effectively.

- Click ‘Get Form’ button to obtain the Billback Form and open it in the designated document editor.

- Begin by entering the invoice date in the specified field, ensuring that the date aligns with the sales in question.

- Next, fill in the invoice number to reference the sales you are addressing.

- In the following section, input the amount of sale for each respective invoice as instructed.

- Proceed to calculate the total sales per invoice by summing the sales amounts entered and recording the total in the corresponding field.

- Indicate the applicable tax rate for each sale, selecting from the provided tax rates; record the corresponding sales/use tax due for each rate.

- Once all applicable tax amounts are calculated, compile the totals and enter the total due in the designated area.

- Check the options regarding payment and future tax collection preferences, completing the selections that apply to your situation.

- If necessary, provide explanations for any paid taxes directly to the State or indicate tax-exempt status in the appropriate fields.

- Finally, sign and date the document before saving your changes, and consider downloading, printing, or sharing the completed form.

Complete your Billback Form online today and ensure your sales tax obligations are met promptly.

While both a billback and an invoice involve charging clients, they serve different purposes. An invoice is a request for payment for goods or services delivered. In contrast, a billback details additional expenses incurred during a project, communicated through a Billback Form. Understanding these distinctions can help you manage financial transactions more effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.