Get Cvd 53-44 Kansas Secretary Of State Certificate Of Conversion To A Kansas Entity Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CVD 53-44 Kansas Secretary Of State Certificate Of Conversion To A Kansas Entity Instructions online

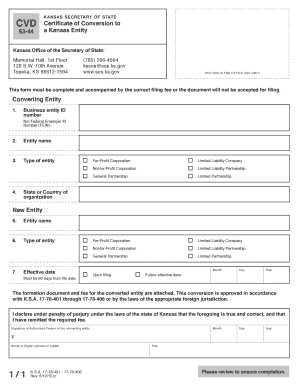

The CVD 53-44 form is essential for individuals or organizations looking to convert their business entity to a Kansas entity. This guide provides step-by-step instructions to help you accurately complete the form online, ensuring that you meet all necessary requirements for filing.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the business entity ID number at the top of the form. This number should not be your Federal Employer ID Number (FEIN).

- Enter the current entity name that you wish to convert, as well as the type of entity (such as for-profit corporation, not-for-profit corporation, general partnership, limited liability company, limited liability partnership, or limited partnership).

- Next, input the state or country of organization for the entity you are converting from.

- Proceed to the new entity section. Here, input the new entity name you are establishing as a Kansas entity. Again, indicate the type of entity for the new formation.

- Specify the effective date for your new entity. This date must be set for 90 days from the date of filing. If you want a future effective date, ensure you mark the appropriate section and provide the month, day, and year.

- Attach the formation document for the new entity along with the appropriate filing fee, which is $75.

- Sign the form where indicated, ensuring that your name is printed or typed, along with your title. This signature is a declaration that all information provided is true and correct under penalty of perjury.

- Once you have completed the form and attached necessary documents, save your changes. You can download, print, and prepare to share the form as required.

Complete and submit your documents online to streamline the conversion process.

If you do not renew your LLC in Kansas, it may face administrative dissolution. This means that your business will lose its legal standing, resulting in consequences like losing the ability to conduct business legally in the state. To avoid this issue, it is crucial to adhere to annual renewal requirements. Guidance on maintaining your LLC can be found in the CVD 53-44 Kansas Secretary Of State Certificate Of Conversion To A Kansas Entity Instructions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.