Get Forms For 2012 Department Assessments And Taxation

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Forms For 2012 Department Assessments And Taxation online

This guide provides a clear and straightforward approach to filling out the Forms For 2012 Department Assessments And Taxation online. Whether you are a sole proprietor or part of a general partnership, following these steps will help ensure accurate and efficient completion of your form.

Follow the steps to complete the form accurately.

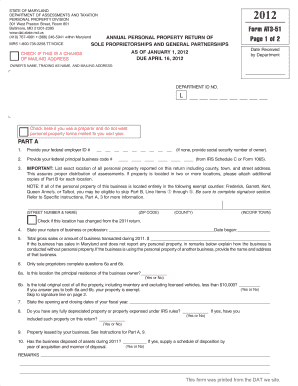

- Press the ‘Get Form’ button to access the form and open it for editing.

- Enter your owner’s name, trading as name, and your mailing address in the designated sections. Ensure that this information is up-to-date.

- Provide your Department ID number and indicate whether this is a change of mailing address.

- Complete Part A by filling in your federal employer ID number and, if applicable, your social security number.

- Input your federal principal business code and the exact location of all personal properties reported, including county and street address.

- Answer all questions regarding the nature of your business, fiscal year dates, and whether you have fully depreciated property or leased assets.

- If applicable, complete Part B, which details your furniture, fixtures, office equipment, and other assets. Make sure to provide original costs and depreciation information as required.

- Upon finishing all sections, review your entries for accuracy and completeness.

- Once confirmed, you can save your changes, download a copy of the completed form, print it, or share it as needed.

Begin your online process and complete your Forms For 2012 Department Assessments And Taxation today.

In Maryland, there is no specific age at which you stop paying property taxes; however, certain exemptions may apply for senior citizens. For residents aged 65 and older, there may be programs that offer tax credits or exemptions, which can lessen the tax burden. If you're exploring forms for 2012 Department assessments and taxation to apply for these benefits, platforms like uslegalforms can provide the necessary resources.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.