Get Dat State Md Us

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dat State Md Us online

This guide provides a comprehensive overview for filling out the Dat State Md Us form, designed specifically for sole proprietorships and general partnerships. By following the steps outlined below, users will be able to complete the form accurately and efficiently.

Follow the steps to complete your Dat State Md Us form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your owner’s name, the trading name, and the mailing address. Ensure to provide accurate details to prevent any correspondence issues.

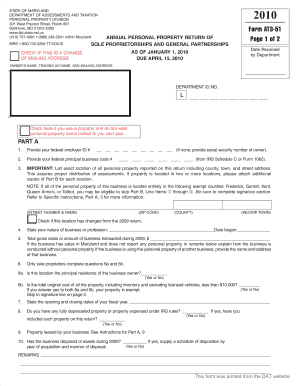

- In Part A, provide your federal employer ID number. If you do not have one, include the social security number of the owner.

- List the exact location of your personal property, including the county, town, and street address. This information is crucial for proper assessment.

- State the nature of your business or profession, and provide the date when the business began operations.

- Indicate the total gross sales or amount of business transacted during the previous year. If your business does not report personal property, briefly explain how it operates.

- If you are a sole proprietor, complete questions related to whether the business location is your principal residence and if the total original cost of all personal property is less than $10,000.

- Provide the opening and closing dates of your fiscal year as required in the form.

- If applicable, report any fully depreciated property or property expensed under IRS rules.

- Complete the sections related to leased property and disposed assets during the reporting period.

- Once all sections are completed, review the form for accuracy, then sign and date it. Include your contact information for any follow-ups.

Get started on your document management journey by completing your Dat State Md Us form online today!

Yes, you can file Maryland state taxes online using the Maryland Comptroller's website. The online system is user-friendly, allowing you to complete your tax returns efficiently. Additionally, e-filing helps you avoid errors and ensures quicker processing of your return. Using uslegalforms can also assist you in understanding the e-filing requirements and guide you through the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.