Get Form 2038 - Forms - Us Department Of Agriculture - Forms Sc Egov Usda

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2038 - Forms - US Department Of Agriculture - Forms Sc Egov Usda online

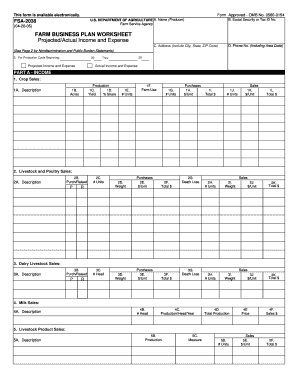

Filling out Form 2038 is a crucial step for individuals seeking to outline their farm business plan, including projected income and expenses. This guide provides clear, step-by-step instructions to help users complete the form easily and accurately online.

Follow the steps to complete Form 2038 effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the producer's name in Section A. Ensure that the name matches the official documents to avoid discrepancies.

- In Section B, provide either the Social Security Number or Tax Identification Number to establish your identity for the records.

- Fill in Section C with the complete address, including city, state, and ZIP code to facilitate correspondence.

- Specify your phone number, including the area code, in Section D for any necessary follow-up.

- Indicate the production cycle start year in Section E, and specify the years for projected and actual income and expenses.

- Move to Part A and start detailing your income. Begin with crop sales. In Section 1, describe the crops, record acreages, yield percentages, units produced, and total sales amounts.

- In Sections 2 and 3, document livestock and dairy sales, including all relevant metrics such as weight, sales prices, and units.

- List any additional sources of income such as ag program payments and crop insurance proceeds in Part A.

- In Part B, transition to expenses. Be thorough in itemizing all costs, from chemicals to utility expenses, ensuring to enter accurate dollar amounts.

- Part C requires details on non-operating income and expenses, including any withdrawals and non-farm income.

- Complete Part D regarding capital by providing details on capital sales and expenditures.

- Finally, review the Acknowledgment section in Part E. Sign and date the form as the applicant and co-applicant, if applicable.

- Once completed, users can save changes, download, print, or share the form as needed.

Start completing your Form 2038 online today for a seamless filing experience.

There are several factors that can lead to a failed USDA appraisal. Common issues include major structural problems, health and safety hazards, or non-compliance with USDA property requirements. It's important to ensure that the property meets all regulations defined by the USDA. Understanding these appraisal standards is crucial when preparing your Form 2038 - Forms - US Department Of Agriculture - Forms Sc Egov Usda submission.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.