Get Chapter 13 Fillable Plan Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Chapter 13 Fillable Plan Form online

Filling out the Chapter 13 Fillable Plan Form online is an essential step in the bankruptcy process. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the Chapter 13 Fillable Plan Form.

- Click the ‘Get Form’ button to access the Chapter 13 Fillable Plan Form. This will open the form in your preferred online editor.

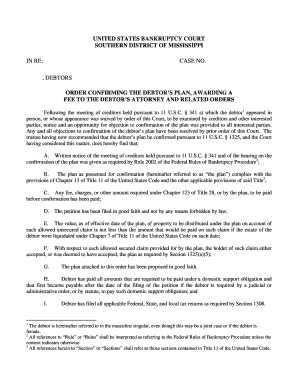

- Begin filling out the case number at the top of the form. This number is essential for identifying your bankruptcy case. Make sure to double-check that it matches the one assigned by the court.

- Enter your name or the name of the debtor in the designated field. If this is a joint case, provide the name of both debtors accordingly.

- Provide the details of your debt and assets. Carefully list all unsecured claims and secured claims in the relevant sections. Be thorough to ensure that your filing is complete and accurate.

- Review the payment plan section and outline how you propose to repay creditors. This part is crucial as it demonstrates your plan's feasibility and alignment with bankruptcy requirements.

- Ensure all necessary signatures are provided at the end of the form. These signatures confirm the plan’s validity and your commitment to adhere to it.

- Once completed, save your changes. You will have the option to download, print, or share the form as needed. Make sure to keep a copy for your records.

Start completing your Chapter 13 Fillable Plan Form online today to take an important step towards financial recovery.

The Chapter 13 plan document is a formal proposal submitted to the bankruptcy court outlining your repayment strategy. This document specifies your financial situation, including income, expenses, and the planned payments to your creditors. It serves as a roadmap for your repayment process and must be filed correctly for court approval. The Chapter 13 Fillable Plan Form is a valuable tool for easily drafting this essential document.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.