Get Cbt 100 And Cbt 100v Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cbt 100 And Cbt 100v Form online

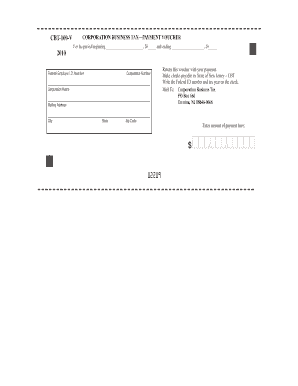

The Cbt 100 And Cbt 100v Form is essential for filing corporate business taxes in New Jersey. This guide provides you with a comprehensive, step-by-step approach to completing the form online, ensuring that you accurately report your tax obligations.

Follow the steps to complete your Cbt 100 And Cbt 100v Form online.

- Click ‘Get Form’ button to access the form and open it in the online editor.

- Enter the period for which you are filing the tax, specifying the beginning and ending dates.

- Provide your Federal Employer I.D. Number in the designated field.

- Input your Corporation Number in the appropriate section.

- Fill out the Corporation Name field clearly, ensuring it matches the official documents.

- Enter your Mailing Address, including City, State, and Zip Code.

- Specify the amount of payment you are submitting in the designated area.

- Review all entries for accuracy and completeness.

- Once satisfied, you can proceed to save your changes, download the completed form, print it, or share it as needed.

Complete your Cbt 100 And Cbt 100v Form online today and fulfill your corporate tax obligations!

CBT tax, or Corporate Business Tax, is a tax imposed on corporations operating in New Jersey. This tax applies to the entire net income or gross receipts of the business, depending on the corporation's structure. Knowledge of this tax is vital for effectively managing your finances and preparing the Cbt 100 and Cbt 100v Form. Accessing resources from uslegalforms can provide clarity and guidance through the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.