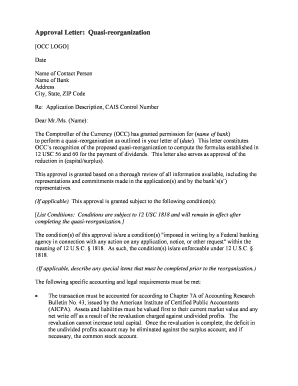

Get Approval Letter: Quasi-reorganization - Occ

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Approval Letter: Quasi-reorganization - Occ online

This guide provides users with a clear and comprehensive approach to filling out the Approval Letter: Quasi-reorganization - Occ. Designed for those with varying levels of experience, it outlines each component of the letter to facilitate a smooth completion process.

Follow the steps to successfully complete your approval letter online.

- Click ‘Get Form’ button to obtain the form and access it in your preferred editor.

- Enter the date in the designated field at the top of the letter.

- Fill in the name of the contact person for the application, ensuring correct spelling and title.

- Provide the name of the bank that is applying for the quasi-reorganization.

- Input the complete address of the bank, including city, state, and ZIP code.

- Write a clear description of the application, including the CAIS control number, in the 'Re:' section.

- Address the letter appropriately, using 'Dear Mr./Ms. (Name)' format.

- In the body of the letter, summarize the approval granted by the OCC. Include the specific date referenced in your application.

- If applicable, list any conditions imposed by the OCC under which the approval is granted.

- Outline any special items or specific accounting requirements that need to be completed prior to the reorganization.

- Mention any necessary certifications, disclosures, or notifications that must be completed following shareholder approval.

- Conclude the letter with a summary of the completion timeline and additional notes regarding the approval.

- Include the contact information for questions, along with a respectful closing.

- Once all fields are filled, review the letter for accuracy, then save changes, download, print, or share the document as needed.

Complete your approval letter online today and ensure all necessary provisions are met.

Filing a complaint with the Consumer Financial Protection Bureau (CFPB) can be worthwhile. They take complaints seriously and investigate them according to their policies. By filing with the CFPB, you not only seek resolution for your situation but also contribute to their efforts in helping others who may face similar issues. Their involvement can lead to necessary changes in bank practices, benefiting consumers as a whole.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.