Get Fsa 851

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fsa 851 online

This guide provides step-by-step instructions for users to effectively complete the Fsa 851 form online, ensuring all necessary information is accurately provided. Whether you are familiar with legal documentation or new to the process, this comprehensive guide will support you in submitting the form correctly.

Follow the steps to successfully complete the Fsa 851 online

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

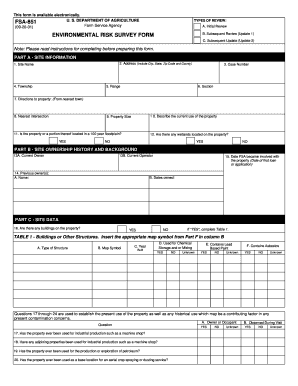

- Begin with Part A – Site Information. Provide the site name, address (including city, state, zip code, and county), township, range, section, and directions to the property. Fill in the nearest intersection and describe the current use of the property, including the property size.

- Indicate whether the property or any portion is located in a 100-year floodplain and if there are any wetlands present on the property.

- Move to Part B – Site Ownership History and Background. Enter the current owner and operator details, along with previous owner information, including names and dates owned. Specify the date when the FSA became involved with the property.

- In Part C – Site Data, answer the questions regarding buildings on the property, and for those present, complete Table 1 by indicating the type of structure, year built, and any relevant environmental concerns such as lead-based paint or asbestos.

- Address questions related to historical uses of the property and adjoining properties that may impact current environmental risks. Complete the corresponding tables for containers, batteries, and abandoned machinery as prompted.

- For Part D – Water and Waste Information, denote the presence of any lagoons, ponds, or wells. Complete the appropriate tables detailing their locations and conditions.

- Continue to Part E – Records Search, answering questions about nearby National Priority List or equivalent sites, and document any leaking underground storage tanks.

- Draw the property boundary in blue ink as required in Part F – Sketch of Property and label it accurately with the appropriate map symbols.

- Finally, in Part G – Conclusion, review and certify the contents of the form, fill in your signature, date, printed name, title, agency/lender, address, and phone number. If updates are relevant, complete Part H before finalizing the form.

- After completing the form, you can save your changes, download it for personal records, print a hard copy, or share it as needed.

Complete the Fsa 851 online today for a seamless filing experience.

Checking your FSA balance is straightforward; you can access it via your employer's FSA management tool or contact your HR department. Your balance reflects your contributions and any expenses claimed. Regularly monitoring this will keep you informed and help you plan your health expenses effectively. For assistance navigating this process, US Legal Forms has useful resources and forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.