Get Form 840

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 840 online

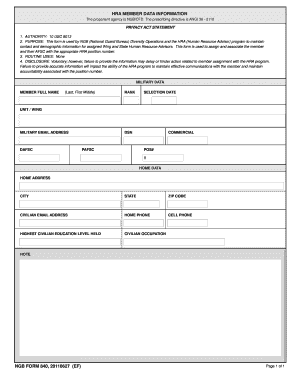

Filling out Form 840 online is a straightforward process that ensures your contact and demographic information is accurately documented for the Human Resource Advisor program. This guide will take you through each step, ensuring that you can complete the form with confidence.

Follow the steps to successfully fill out Form 840 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your full name in the 'Member Full Name' field, ensuring you include your last name, first name, and middle initial where applicable.

- In the 'Rank' section, input your current military rank.

- Fill in your 'Unit/Wing' to which you are assigned.

- Switch to the 'Home Data' section and fill in your 'Home Address' accurately.

- List your 'Civilian Email Address' for personal communications.

- Once all fields are completed, review your entries for accuracy. You can then save changes, download, print, or share the completed form as needed.

Start filling out your Form 840 online today for efficient and accurate documentation.

The Form 840 is a specific tax form used for state tax filings, primarily in certain states. It plays a crucial role in reporting income and calculating tax obligations for residents and non-residents. Understanding the details of Form 840 can help you stay compliant with tax laws. If you need help navigating this form, US Legal Forms offers guidance and templates to simplify the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.