Get Tangible Net Benefit Worksheet For State Of Georgia Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tangible Net Benefit Worksheet For State Of Georgia Form online

Filling out the Tangible Net Benefit Worksheet for the State of Georgia is essential for ensuring compliance during loan refinancing. This guide provides clear, step-by-step instructions to assist users in completing the form online with confidence.

Follow the steps to effectively complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

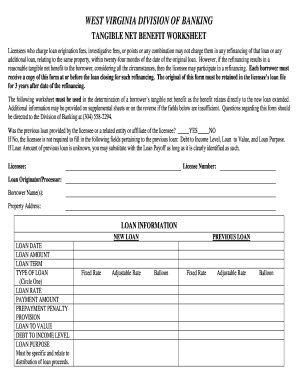

- Enter the licensee information, which includes the licensee's name and license number.

- Input the loan originator or processor's information, including their name.

- Provide the borrowers' names and the property address where the loan is secured.

- In the 'Loan Information' section, provide details about the new loan, including loan date, amount, term, type, rate, payment amount, and any applicable prepayment penalty provisions.

- Indicate the loan-to-value and debt-to-income levels, ensuring these relate specifically to the new loan.

- Specify the loan purpose, detailing how the loan proceeds will be distributed.

- In the 'Previous Loan' section, if applicable, repeat the process for the previous loan's details unless the loan was provided by an unrelated entity.

- Complete the section titled 'Loan Originator to Complete,' documenting the tangible net benefit the borrower has received through refinancing.

- Have the appropriate signatures recorded, including the loan originator's signature and print details, along with the approval from the manager or officer.

- Ensure both borrowers sign the borrower certification confirming their understanding and acknowledgment of the loan benefits.

- Once all fields are completed, review the form for accuracy and then save changes, download, print, or share the completed form as needed.

Complete your Tangible Net Benefit Worksheet online today to streamline your loan refinancing process.

Non-recourse mortgages are available in several states, offering unique benefits to borrowers. The twelve states that typically offer such loans include California, Arizona, Oregon, and Texas, among others. These mortgages limit the lender's ability to pursue borrowers beyond the collateral_value in case of default. For residents, understanding these options can be enriched by referring to resources like the Tangible Net Benefit Worksheet For State Of Georgia Form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.