Loading

Get Virginia 762 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Virginia 762 Form online

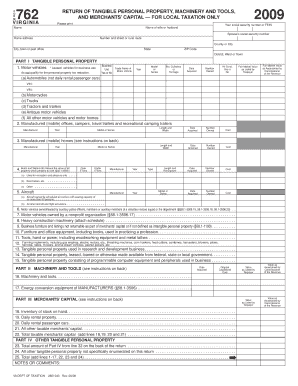

The Virginia 762 form is essential for reporting tangible personal property, machinery and tools, and merchants' capital for local taxation. This guide provides clear instructions to help users fill out the form online easily.

Follow the steps to fill out the Virginia 762 Form online

- Click ‘Get Form’ button to obtain the Virginia 762 Form and open it in the editor.

- Begin by entering your name, Social Security number or FEIN, and any pertinent information about your spouse, including their name and Social Security number. Complete your home address, including city, county, and state.

- Move to Part I, Tangible Personal Property. Fill out the details for motor vehicles that you own. This includes entering the trade name of the vehicle, year, model or series, number of cylinders or tonnage, and additional fields regarding fair market value.

- Continue completing Part I by providing information for other listed categories such as manufactured offices, watercraft, and aircraft. Specify the manufacturer, year, model, and any relevant costs.

- Complete Part II by reporting the original capitalized cost and values for any machinery and tools utilized in your business.

- In Part III, list your merchants' capital. Report inventory and other property required for taxation including any daily rental property.

- In Part IV, summarize any other tangible personal property you may own that is not mentioned earlier. Enter totals where prompted.

- Review all entered information for accuracy. Make sure to write 'None' beside any items of property that do not apply to you.

- Once you have completed filling out the form, save your changes, and download or print the form. You can also share it as needed.

Complete your Virginia 762 Form online today for efficient and accurate local taxation reporting.

You can obtain Virginia form 760 from the Virginia Department of Taxation's website or at local tax offices. Furthermore, public libraries often have copies available on-site for quick access. To save time, explore US Legal Forms, where you will find the Virginia 762 Form along with other essential tax forms ready for download.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.