Loading

Get 760c Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 760c Form online

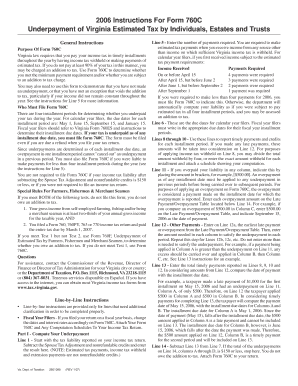

Filing the 760c Form online can seem daunting, but understanding its components and requirements is essential for proper tax compliance. This guide will walk you through each step involved in completing the 760c Form efficiently and accurately.

Follow the steps to successfully complete the 760c Form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Carefully read the general instructions at the beginning of the form to understand the purpose of the 760c Form and determine if you are required to file it based on your tax liability.

- Complete Part I of the form, which involves computing your underpayment. Start with your reported tax liability and adjust for any spouse tax adjustments and nonrefundable credits.

- In Line 5, indicate the number of estimated tax payments required based on your income received throughout the year and the respective payment deadlines.

- Document any timely payments and credits for each installment period in Lines 8 through 10. Note that overpayment in previous periods may impact current computations.

- Check Line 14 to subtract your total timely payments from your total liability to gauge if you owe any addition to tax.

- If applicable, proceed to Part II to evaluate if any exceptions apply to void the addition to tax by completing the necessary exceptions calculations.

- In Part III, compute the addition to tax if any underpayments were identified, using the guidelines provided for each relevant line.

- Review the completed form thoroughly for accuracy and completeness before submitting.

- Once everything is filled out, you can save your changes, download, print, or share the form as necessary.

Complete your 760c Form online today to ensure compliance with Virginia tax regulations.

Virginia generally requires residents to file a tax return if their income exceeds a specific threshold set by the state. If you receive income from wages, self-employment, or other sources, filing the 760C form becomes necessary. To ensure compliance and avoid penalties, it’s best to consult resources that provide clear instructions on the requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.