Loading

Get 763 S Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 763 S Form online

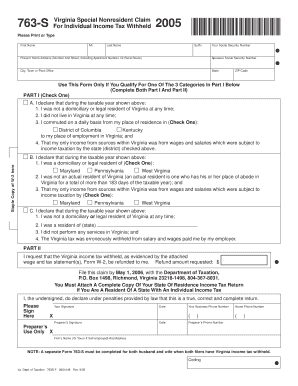

The 763 S Form is used for claiming a refund of Virginia income tax withheld for individuals who qualify under certain categories. This guide will provide clear, step-by-step instructions on how to complete the form online.

Follow the steps to fill out the 763 S Form accurately.

- Press the ‘Get Form’ button to access the form and open it in your chosen editor.

- Begin by entering your first name, middle initial, last name, and any suffix in the appropriate fields at the top of the form.

- Provide your Social Security Number (SSN) in the designated section to ensure proper identification.

- Enter your current home address, including street number, apartment number (if applicable), city, state, and ZIP code.

- If applicable, enter your spouse's Social Security Number in the designated field.

- Select one of the three categories in Part I that best describes your situation by checking the appropriate box. Each category has specific requirements to fulfill.

- Complete both Part I and Part II as instructed based on your chosen category, providing specific details about your income and residency status.

- Attach a complete copy of your state of residence income tax return if you are a resident of a state with an individual income tax.

- Provide the requested refund amount in Part II, ensuring that it aligns with the tax withheld as evidenced by the attached wage and tax statement (Form W-2).

- Sign and date the form in the designated signature areas. If applicable, a preparer's signature will also need to be included.

- After thoroughly reviewing the completed form for accuracy, save your changes, and you may choose to download, print, or share the form as needed.

Start filling out your 763 S Form online today to ensure a smooth refund process.

The 760, 760PY, and 763 forms are types of Virginia tax returns, each serving different scenarios. The 760 is typically used by residents, the 760PY is for part-year residents, and the 763 is a non-resident return. Understanding these distinctions is vital to ensure you file the correct form for your situation. US Legal Forms offers comprehensive resources to help you choose the right return and correctly fill it out.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.