Get Va Tire Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Va Tire Tax online

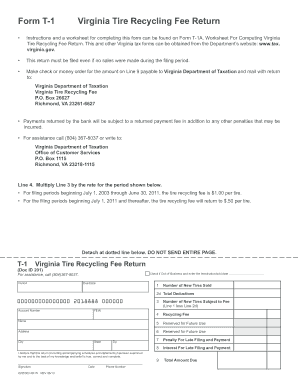

Filing the Virginia Tire Recycling Fee Return, commonly known as the Va Tire Tax, is a necessary process for reporting tire sales. This guide provides clear instructions to help users complete the form accurately and efficiently online.

Follow the steps to complete the Va Tire Tax online.

- Click ‘Get Form’ button to acquire the form and open it in your preferred document editor.

- Enter your account number, FEIN, name, address, city, state, and zip code in the designated fields on the form.

- Indicate if you are out-of-business by checking the appropriate box and provide the termination or sold date if applicable.

- Specify the period for which you are filing the return by selecting the appropriate due date.

- List total deductions on Line 2d as necessary; these could include any returns or allowances.

- Multiply the total number of tires on Line 3 by the recycling fee rate applicable for your filing period and input this amount on Line 4.

- Complete Lines 5 and 6 with any reserved future use; leave blank if not applicable.

- If you are filing late, calculate and enter any applicable penalties for late filing and payment on Line 7, along with any interest due on Line 8.

- Calculate the total amount due and enter this final figure on Line 9.

- Once you have filled out the form entirely, save your changes, and utilize options to download, print, or share the document as necessary.

Start completing your Va Tire Tax online today to ensure compliance and avoid penalties.

You can file your VA tax returns online through the Virginia Department of Taxation's official website. Alternatively, you may choose to use several tax filing software options that offer easy procedures for submitting your returns. If you prefer to file by mail, ensure you send your forms to the appropriate address listed on the Virginia tax website. For assistance specific to the VA Tire Tax, using a platform like uslegalforms can simplify your filing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.