Loading

Get Form 502 Schedule Vk 1 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 502 Schedule Vk 1 Instructions online

Filling out the Form 502 Schedule Vk 1 can be straightforward if you follow the proper instructions. This guide offers a step-by-step approach to ensure you complete the form accurately and efficiently, helping you navigate through each section with confidence.

Follow the steps to complete your Form 502 Schedule Vk 1 successfully.

- Press the ‘Get Form’ button to access the form and open it in your web editor.

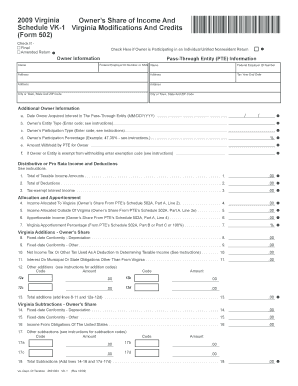

- Provide owner information by entering the name and any applicable owner identifiers. Ensure that the details match official records to avoid discrepancies.

- Input the Pass-Through Entity (PTE) information, including the Federal Employer ID Number or Social Security Number, along with the PTE name and address.

- Fill in the tax year end date for the report you're submitting, and ensure it corresponds with the reporting entity's financial information.

- Complete the additional owner information section. Necessary details include the date the owner acquired interest in the entity, participation type, percentage, and any amounts withheld.

- Detail the distributive or pro-rata income and deductions by entering figures for total taxable income, deductions, and any tax-exempt interest income.

- In the allocation and apportionment section, indicate the income allocated to Virginia and any amounts allocated outside of Virginia.

- Complete the Virginia additions and subtractions sections as instructed. Pay close attention to the codes for added or subtracted amounts.

- Fill in the nonrefundable and refundable credits based on eligibility. Refer to the instructions for specific credits available.

- Review the entire form for accuracy. Once complete, you may save changes, download, print, or share the form as needed.

Complete your Form 502 Schedule Vk 1 online today for a hassle-free filing experience.

Schedule 1 is for individuals who have additional income or adjustments to their total income. This often includes partnership income, rental income, or certain types of business income. If your income sources are straightforward, you may not need this schedule. For clarity and support, refer to the Form 502 Schedule Vk 1 Instructions found on US Legal Forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.