Loading

Get Virginia 502w

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Virginia 502w online

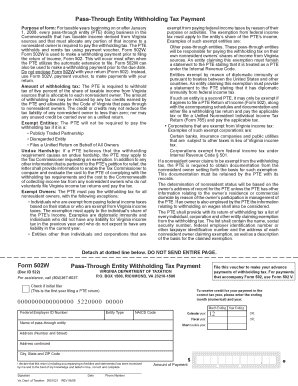

This guide provides clear and useful instructions for completing the Virginia 502w online. The Virginia 502w form is essential for pass-through entities to report withholding tax payments for nonresident owners, ensuring compliance with Virginia tax regulations.

Follow the steps to complete your Virginia 502w online.

- Press the ‘Get Form’ button to access the Virginia 502w form and open it for editing.

- Enter the federal employer identification number (FEIN) for your entity in the designated field.

- Specify the entity type by selecting the appropriate code from the provided list, such as SC for S corporation or PG for general partnership.

- Fill in the NAICS code, which is a 6-digit number that corresponds to your entity's primary business activity.

- Indicate the ending month and year for the payment, ensuring it aligns with the tax year for which the payment is being made.

- Complete the section with the name and address of the pass-through entity, ensuring accuracy for correspondence.

- Calculate the amount of withholding tax owed by either determining the taxable income of the PTE or directly for each nonresident owner, applying the 5% tax rate accordingly.

- Enter the total amount withheld in the payment section of the form.

- Review all entered information for accuracy before proceeding to sign and date the form.

- Once completed, users can save changes, download, print, or share the form as needed.

Complete your Virginia 502w form online today to ensure timely tax compliance.

The withholding tax rate in Virginia is determined based on the employee’s income bracket and filing status. Typically, the rates can range from 2% to 5.75% of an employee's taxable income. For accurate calculations, employers should refer to the latest guidelines provided by the Virginia Department of Taxation, ensuring compliance and accurate payroll processing with the Virginia 502W form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.