Loading

Get Tc40v 2009 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tc40v 2009 Form online

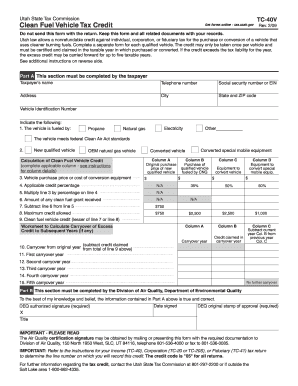

The Tc40v 2009 Form allows users to claim a nonrefundable tax credit for purchasing or converting a vehicle that uses cleaner burning fuels. Following this guide will help you navigate the online process of completing the form accurately.

Follow the steps to complete the Tc40v 2009 Form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part A, enter the taxpayer's name, telephone number, social security number or EIN, address, city, state, and ZIP code. This section must be completed by the taxpayer.

- Provide the Vehicle Identification Number (VIN) of the vehicle for which you are claiming the credit.

- Indicate how the vehicle is fueled by selecting one of the options: Propane, Electricity, Natural gas, or Other.

- Confirm if the vehicle meets federal Clean Air Act standards by checking the appropriate box.

- Indicate if the vehicle is a new qualified vehicle.

- Complete the calculation of the Clean Fuel Vehicle Credit by filling in the purchase price or the cost of conversion equipment in the appropriate section.

- Multiply the amount in line 3 by the applicable percentage found in line 4.

- If applicable, subtract any clean fuel grant received from the calculated amount.

- Write the maximum credit allowed and determine the lesser value for your clean fuel vehicle credit.

- If you have carryover credits, fill out the worksheet provided in the form for subsequent years.

- In Part B, leave the section for DEQ authorized signature and date signed blank, as it is to be completed by the Division of Air Quality.

- Review all completed fields for accuracy and ensure you have all necessary supporting documentation.

- Once finished, save any changes, and prepare to download, print, or share the form if needed.

Complete your Tc40v 2009 Form online today for a cleaner vehicle credit.

Failing to file your Utah taxes can result in penalties and interest on any taxes owed. It's crucial to stay compliant, especially if you need to submit forms like the TC40v 2009 Form for state-specific credits. Seeking assistance from platforms like uslegalforms can help ensure you meet your tax obligations and avoid unnecessary complications.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.