Loading

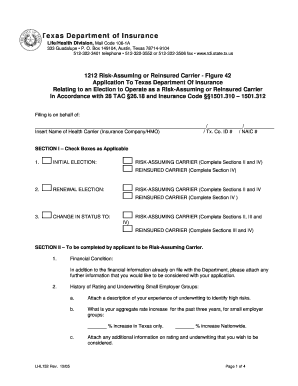

Get Risk-assuming Or Reinsured Carrier Application - Lhl152 Rev 12/05 - Tdi Texas

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Risk-Assuming Or Reinsured Carrier Application - LHL152 Rev 12/05 - Tdi Texas online

Filling out the Risk-Assuming Or Reinsured Carrier Application - LHL152 Rev 12/05 is an essential step for health carriers looking to operate as a risk-assuming or reinsured carrier in Texas. This guide provides a detailed roadmap to help you complete the application accurately and efficiently online.

Follow the steps to fill out the application correctly.

- Press the ‘Get Form’ button to obtain the application and open it in your preferred online document editor.

- Begin the application by selecting the appropriate check box for your submission type: Initial Election, Renewal Election, or Change in Status. Depending on your selection, note which sections you need to complete.

- If you are applying as a Risk-Assuming Carrier, complete Section II. This section requires you to provide information about your financial condition. Attach any additional financial documents that you want the department to consider.

- Complete the subsection on history of rating and underwriting for small employer groups. Include your three-year rate increase percentages for Texas and nationwide, along with any relevant attachments.

- Describe your commitment to market fairly to all small employers in the specified areas. This includes attaching any marketing materials to be used.

- Discuss your experience managing the risk of small employer groups. Here, you will provide data on other states where you offer coverage and detail how you manage guaranteed issues.

- In Section IV, identify a contact person by providing their printed name, signature, contact number, and fax number. Ensure to check their title as Chief Executive Officer, Actuary, or Attorney.

- Review all entries for accuracy, then save your changes. After verification, you can download the application for your records or print it directly if needed. Ensure to return the completed form to the Texas Department of Insurance based on the provided address.

Complete your Risk-Assuming Or Reinsured Carrier Application online now to ensure timely processing.

What Is the Texas Prompt Payment Act? The Texas Prompt Payment Act of 2003 requires insurance companies pay out claims within 60 days of receiving the forms, statements, and anything else required for a claim. The law also provides penalties for companies that provide an on-time payment that is lower than it should be.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.