Get Tn In 0579 Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tn In 0579 Fillable Form online

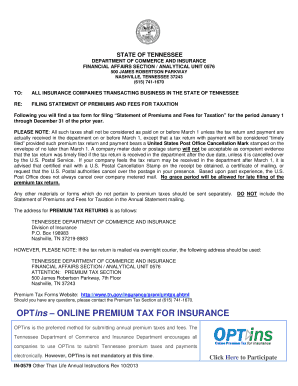

Completing the Tn In 0579 Fillable Form is essential for insurance companies in Tennessee to file their statement of premiums and fees for taxation. This guide provides clear, step-by-step instructions to help users navigate the form effectively and ensure accurate submission.

Follow the steps to complete your Tn In 0579 Fillable Form online.

- Click the ‘Get Form’ button to access the Tn In 0579 Fillable Form and open it in your editor.

- Begin by filling in the company name and mailing address on the first page of the form. Ensure that the contact person's details, including their email address and phone number, are accurate.

- Specify the calendar year that the form pertains to and fill in the NAIC company code that corresponds to your insurance company.

- Indicate the date when your company was admitted to Tennessee and include your domiciliary state. Additionally, provide the Federal Employer Identification Number (FEIN).

- Report the premiums collected in the prior calendar year along with the associated taxes, including the general premium tax at 2.5% and the workmen’s compensation tax at 4%, detailing each line item carefully.

- Calculate and enter the total tax due based on the premiums reported. If the total is below the minimum tax threshold of $150, ensure to enter $150.

- Complete Schedule B, which calculates the fire marshal tax based on direct premiums. List all applicable insurance lines and calculate the fire portion subject to the tax.

- If applicable, fill out Schedule C, which requires itemization of Tennessee and next highest state investments. Attach supporting spreadsheets as necessary.

- Complete Schedule D to compute any retaliatory taxes. Provide documentation for all taxes and fees assessed in Tennessee and the state of incorporation.

- Affix the signature of the authorized officer and ensure the form is notarized. Submit the completed form by mail to the Department of Commerce and Insurance by the designated deadline.

- After completing the form, users can save their changes, download a copy, print the document, or share it as needed.

Take the necessary steps to complete your Tn In 0579 Fillable Form online today!

Businesses in Tennessee typically need to use specific forms based on their entity type, and these forms can be found through the state's department of revenue. The TN In 0579 fillable form can also apply to different business scenarios, allowing for easy filing of various tax obligations. Understanding which forms are relevant to your business is critical for compliance with state regulations. Always check for the latest forms and requirements annually.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.