Get Application For Cancellation Of Forfeiture - Minnesota Department Of ... - Revenue State Mn

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application for Cancellation of Forfeiture - Minnesota Department of Revenue online

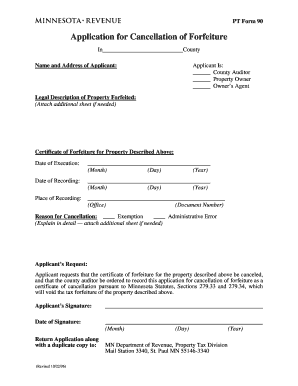

The Application for Cancellation of Forfeiture is an important document for property owners, agents, and county auditors in Minnesota seeking to cancel a tax forfeiture. This guide provides a step-by-step approach to filling out the form online, ensuring that all necessary components are completed accurately.

Follow the steps to successfully complete the application online.

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

- Begin by entering the county name in the designated area at the top of the form.

- Fill in the ‘Name and Address of Applicant’ section with the appropriate information.

- Select the correct box to identify the applicant, whether they are the County Auditor, Property Owner, or Owner’s Agent.

- Provide the 'Legal Description of Property Forfeited' in the specified field. If additional space is needed, attach an extra sheet.

- Complete the 'Certificate of Forfeiture for Property Described Above' section by entering the date of execution and recording. Make sure to specify the month, day, and year accurately.

- Enter the Place of Recording, Office, and Document Number as required.

- Choose the Reason for Cancellation by checking the applicable box and provide a detailed explanation attached on another sheet if necessary.

- In the 'Applicant's Request' section, confirm that the applicant requests cancellation of the forfeiture and order for proper recording.

- Have the applicant sign and date the application where indicated.

- Review the application for completeness and accuracy before submitting.

- Return the completed application along with a duplicate copy to the Minnesota Department of Revenue, Property Tax Division, using the address provided.

Complete your application online today to ensure your cancellation of forfeiture is processed efficiently.

You can contact the Minnesota Department of Revenue through various channels. Their official website provides essential resources and contact information for inquiries. For direct assistance, you can call their customer service number or visit one of their regional offices. Whether you’re seeking information about the Application For Cancellation Of Forfeiture - Minnesota Department Of Revenue State Mn or other services, they are ready to assist.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.