Loading

Get St 11p Mn Dept Of Revenue Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St 11p Mn Dept Of Revenue Form online

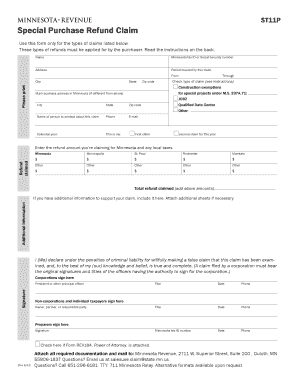

The St 11p Mn Dept Of Revenue Form is used to claim refunds for Minnesota sales and use tax, as well as local sales and use taxes. This guide provides clear, step-by-step instructions on how to fill out this form online.

Follow the steps to fill out the form accurately and efficiently.

- Press ‘Get Form’ button to access the St 11p form and open it in your preferred editor.

- Begin by entering your name, Minnesota tax ID or Social Security number, and address in the specified fields. Ensure all details are accurate and printed clearly.

- Indicate the period covered by your claim by selecting the start and end dates.

- If your main business address is different from your primary address, provide the updated business address details accurately.

- Specify the name of the person to contact about this claim along with their phone number and email address.

- Check the appropriate claim type box according to your eligibility, such as construction exemptions, JOBZ, qualified data center, or other. Review the instructions for what qualifies under each category.

- State the calendar year for which you are filing your claim and select if this is your first or second claim for the year.

- Enter the refund amount you are claiming for Minnesota and any local taxes in the designated fields provided for various locations.

- If you have additional information to support your claim, include it in the space provided or attach additional sheets if necessary.

- Read the declaration carefully and ensure you or the responsible party signs the form, along with titles and dates where necessary.

- If applicable, ensure to attach Form REV184, Power of Attorney, before submission.

- Once you have completed all the sections and double-checked the accuracy of the information, save your changes. You can then download, print, or share the form as needed.

Complete your St 11p Mn Dept Of Revenue Form online today to ensure timely processing of your claim.

The M1X form is used in Minnesota to amend a previously filed income tax return. This form allows taxpayers to correct errors or adjust their tax situations. If you are working with the St 11p Mn Dept Of Revenue Form, it’s essential to ensure the accuracy of your filings, making the M1X form an important tool for tax resolution.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.