Loading

Get Pdr1t Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pdr1t Form online

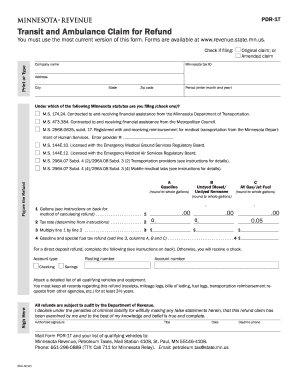

The Pdr1t Form is essential for claiming refunds for excise taxes paid on gasoline or special fuels used for qualified purposes. This guide provides clear and supportive instructions on completing the form online, ensuring that users can navigate the process effectively.

Follow the steps to fill out the Pdr1t Form with ease.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- Fill in the company name, and check whether you are filing an original or amended claim. Provide your Minnesota tax ID.

- Enter the address, city, state, and zip code for your company in the appropriate fields.

- Specify the reporting period by selecting the month and year for which you are making the claim.

- Indicate under which Minnesota statute you are filing by checking the relevant box.

- Calculate the refund by entering the gallons of fuel used in eligible vehicles on line 1. Ensure you follow any specific instructions for calculating the refund.

- Determine and enter the appropriate tax rate based on the filing period on line 2.

- Multiply the figure from line 1 by the tax rate on line 2 and enter the result on line 3.

- Add the totals from line 3 for gasoline and special fuel taxes to complete line 4.

- If choosing direct deposit, fill in the related bank account type, routing number, and account number.

- Review all entered information for accuracy, sign the form, and provide your title and date.

- Attach a detailed list of all qualifying vehicles and relevant documentation. Keep all records for at least 3½ years.

- Save your changes, then download, print, or share the completed form as necessary.

Start filling out your Pdr1t Form online today to ensure you claim your refund efficiently.

When filing your T1 form, you will typically need documents such as income statements, receipts for deductions, and your social security number. Make sure to gather all necessary paperwork to ensure a smooth filing process. Uslegalforms can provide you with checklists or templates to help you organize and prepare all required documents, including the Pdr1t Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.