Loading

Get Abr, Application For Business Registration - Revenue State Mn

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ABR, Application For Business Registration - Revenue State Mn online

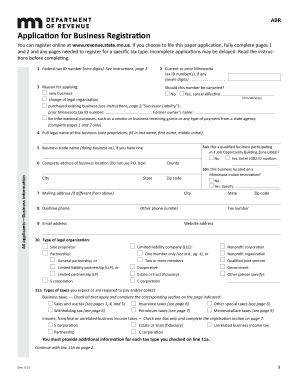

Filling out the ABR, Application For Business Registration, is an essential step for businesses looking to establish their presence in Minnesota. This guide offers a comprehensive overview of the form, ensuring users can complete it accurately and confidently.

Follow the steps to complete your application effectively.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Provide your federal tax ID number, which consists of nine digits. If applicable, include your current or prior Minnesota tax ID number, which contains seven digits.

- Indicate the reason for applying, such as starting a new business, changing legal organization, or purchasing an existing business. If applicable, enter the former owner’s tax ID number and their name.

- Enter the full legal name of the business. Sole proprietors should list their last name, followed by their first name and middle initial.

- If you have a business trade name (often referred to as 'doing business as'), provide it in the designated field. Confirm if your business is located on a Minnesota Indian reservation.

- Fill in the complete address of the business location. Remember not to use a P.O. box. Include county, city, zip code, and state.

- If your mailing address differs from your business address, provide that information here.

- Enter your daytime phone number and, if applicable, provide your email address and additional contact details.

- Select the type of legal organization your business represents, such as sole proprietorship, partnership, nonprofit corporation, etc.

- Indicate the types of taxes you expect or are required to collect, such as sales and use tax, income tax, or other applicable taxes.

- Provide the six-digit NAICS code(s) that correspond to your business activities. If you are unfamiliar with the NAICS code, refer to the provided online resource for assistance.

- If applicable, list individuals who are owners, officers, or trustees, including their details such as Social Security number, date of birth, and contact information.

- Review all entered information for accuracy. Once you have completed the form, you can save your changes, download, print, or share the completed document.

Complete your ABR application online today for a seamless registration experience.

How much is the self employment tax for Minnesota? Anyone who has their own business is obligated to pay Minnesota self employment tax, which covers Social Security and Medicare. The total Minnesota self employment tax is 15.3%, divided into a Social Security amount of 12.4% and a Medicare amount of 2.9%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.