Get Mn Form M63

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mn Form M63 online

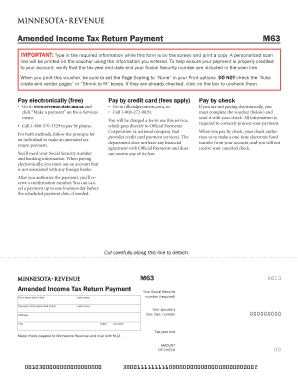

Filling out the Mn Form M63 online is a straightforward process designed to ensure that your amended income tax return payment is submitted correctly. This guide will walk you through each step, providing clear instructions to help you complete the form with ease.

Follow the steps to successfully complete the Mn Form M63.

- Click the ‘Get Form’ button to access the form and open it in your browser or application.

- Begin by entering your first name and initial in the designated field, followed by your last name.

- Next, input your partner's (spouse’s) first name and initial, along with their last name if filing jointly.

- Enter your Social Security number in the provided space, ensuring accuracy as it is required for processing.

- If applicable, fill in your spouse’s Social Security number as well.

- Complete the address section by providing your street address, city, state, and zip code.

- Indicate the last day of the tax year for which you are amending your return, using the specified format.

- Lastly, input the amount of your check if you are paying by check.

- Review all entries for accuracy. Ensure that your Social Security number and tax-year end date are clearly visible in the printed scan line.

- Once completed, save your changes, and proceed to download, print, or share the form as needed.

Get started now and complete your Mn Form M63 online with confidence.

Calculating your Minnesota taxable income involves determining your federal adjusted gross income and making necessary state-specific adjustments. You'll want to consider various deductions, including property tax payments, which could affect your overall tax liability. Utilizing resources like uslegalforms can simplify the process of filling out the Mn Form M63, ensuring you accurately report your income and potential deductions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.