Loading

Get 2011m1pr Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011m1pr Form online

The 2011m1pr Form is essential for individuals seeking property tax refunds in Minnesota. This guide will walk you through each section of the form, offering detailed instructions to ensure a smooth and efficient completion process.

Follow the steps to fill out the 2011m1pr Form online

- Press the ‘Get Form’ button to acquire the 2011m1pr Form and open it in the online editor.

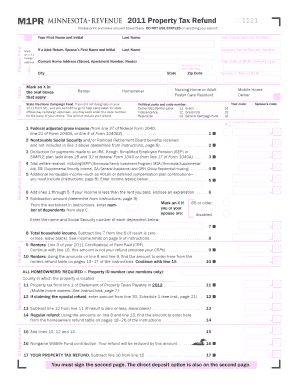

- Begin by entering your last name and Social Security Number in the designated fields. If filing jointly, include your partner’s first name and initial, last name, and Social Security Number.

- Complete your current home address, including street, apartment number, city, state, and zip code. Make sure to check the box if this is a new address.

- Fill in your date of birth and your partner’s date of birth if applicable.

- Mark an X in the oval boxes for the applicable categories: State Elections Campaign Fund, Renter, Homeowner, Nursing Home or Adult Foster Care Resident.

- Provide your household income details as required. Start by calculating your federal adjusted gross income and enter it in line 1.

- Follow subsequent instructions to fill out additional income lines, including Social Security benefits, IRA deductions, total welfare received, and any additional nontaxable income.

- After calculating your total household income, enter the amounts designated for renters or homeowners as instructed on the form.

- If you are a homeowner, ensure to input the required property ID number and property tax information.

- For special refunds, complete Schedule 1 according to the guidelines provided.

- Once all sections are completed, review your entries for accuracy.

- Save your changes, and depending on your needs, select to download, print, or share the completed 2011m1pr Form.

Begin filling out your 2011m1pr Form online today for a timely submission!

All Minnesota Department of Revenue forms, including the 2011m1pr Form, are available on their official website. Simply navigate to the forms section, where you can easily locate and download the forms you need. This is a reliable way to ensure you have the most current versions of all necessary documents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.