Loading

Get M1prx, Amended Property Tax Refund Return - Minnesota ... - Revenue State Mn

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the M1PRX, Amended Property Tax Refund Return - Minnesota online

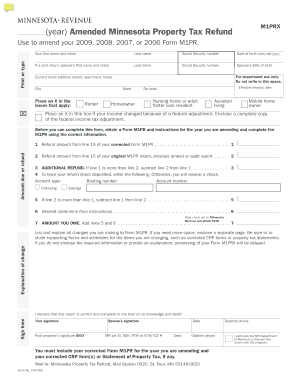

The M1PRX form is essential for those who need to amend their original property tax refund request in Minnesota. This guide provides clear, step-by-step instructions on how to complete the form accurately and efficiently online.

Follow the steps to complete your M1PRX form online effectively.

- Click the ‘Get Form’ button to access and download the M1PRX form for your use. You should see the form open, ready for you to fill out.

- Enter your name and address carefully. Ensure you provide your correct current name and address. If you have changed your name since your original filing, explain the change in the designated area.

- Indicate your filing status by placing an X in the appropriate boxes that apply to you, including whether you are a renter, homeowner, nursing home resident, etc.

- If applicable, indicate any income changes due to federal adjustments by checking the corresponding box. Attach a complete copy of the federal income tax adjustment.

- Input the corrected refund amount from line 15 of your amended Form M1PR in the designated field on line 1.

- Enter the original refund amount from line 15 of your initial Form M1PR on line 2.

- If the corrected refund amount is greater than your original refund, calculate your additional refund by subtracting line 2 from line 1 and enter it in line 3. Sign at the bottom if this applies to you.

- If the original refund amount is more than the corrected amount, subtract the corrected amount from the original and enter that number on line 5. Then calculate any interest due on line 6 and add it with your owed amount on line 7.

- For a direct deposit of your refund, fill out the account type, routing number, and account number on line 4. Make sure to provide accurate banking details to avoid delays.

- Follow the provided instructions to calculate any interest if you owe on line 6 and total that amount with any other debts on line 7.

- Conclude by signing the form and including any required additional forms such as your corrected Form M1PR and property tax statements. Select where to send your completed Form M1PRX.

Start filling out your M1PRX form online today to ensure your amended property tax refund is processed correctly.

Yes, you can e-file a Minnesota amended return. The e-filing option streamlines the process and allows for quicker processing times. Use certified tax software that supports M1PRX, Amended Property Tax Refund Return - Minnesota ... - Revenue State Mn., and follow the prompts for amended returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.